Roth 401k Annual Limit 2024. For 2024, the compensation limit (which is the amount of your income that’s used to figure out 401(k) contributions and matches) is limited to $345,000. Those 50 and older can contribute an additional $7,500.

Traditional 401k up to employer match. Beginning this year (2024), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts.

The Thrift Savings Plan (Tsp) Is A Retirement Savings And Investment Plan For Federal Employees And Members Of The Uniformed Services, Including The Ready.

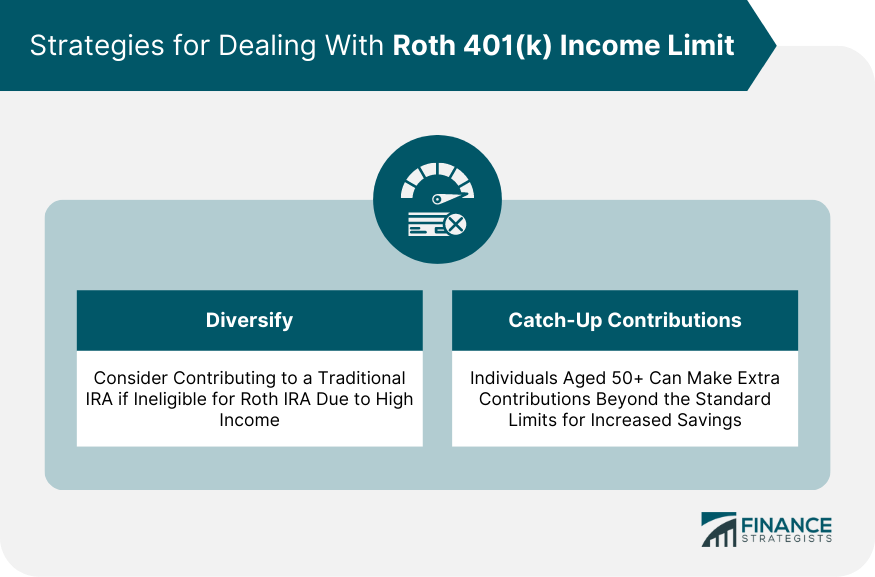

Unlike roth iras, roth 401 (k)s don't have income limits.

This Year, Defined Contribution Plans Got A Historic Contribution Limit.

The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

In 2024, This Rises To $23,000.

Images References :

Source: esmebmicaela.pages.dev

Source: esmebmicaela.pages.dev

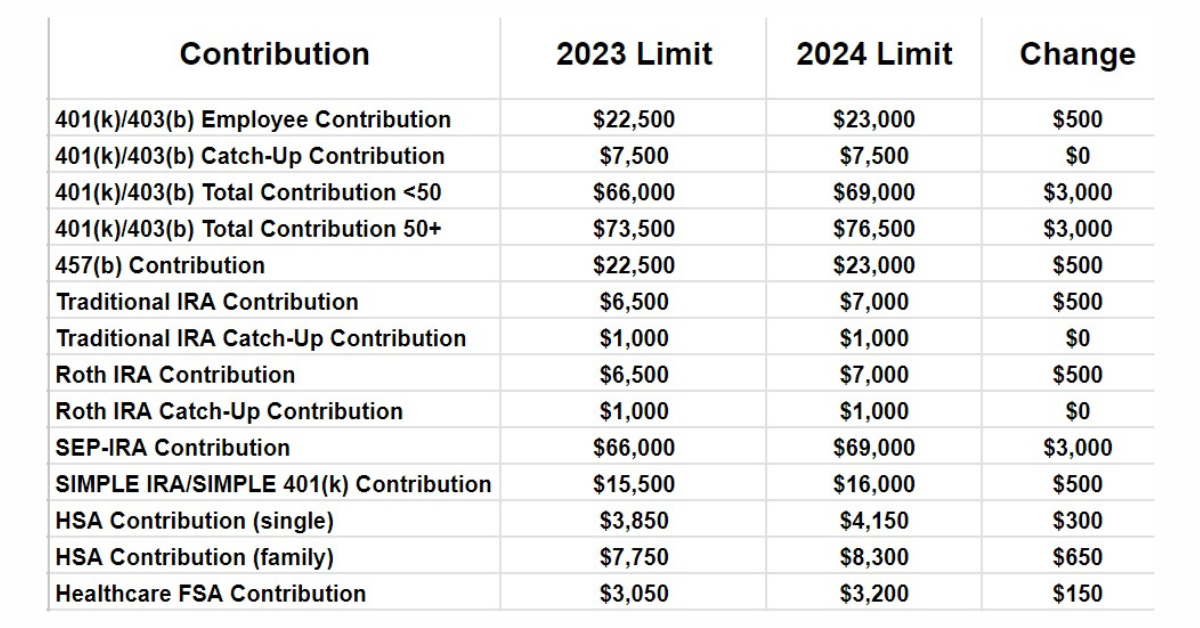

2024 Roth Maximum Contribution Gina Phelia, Employees can invest more money into 401(k) plans in 2024, with contribution limits increasing from $22,500 in 2023 to $23,000 in 2024. For 2024, the 401(k) limit for employee salary deferrals is $23,000, which is above the 2023 401(k) limit of $22,500.

Source: joeannwdrusie.pages.dev

Source: joeannwdrusie.pages.dev

2024 Roth Ira Contribution Limits 2024 Amount Lenka Mariana, What is the maximum employee and employer roth 401k contribution in 2024? So, owners of these roth 401(k) accounts no longer have to take.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

SelfDirected Roth Solo 401k Contribution Limits for 2024 My Solo, Those 50 and older can contribute an additional $7,500. So if you earn at least $8,000 in 2024, you'll be able to contribute the full amount.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, Those 50 and older can contribute an additional $7,500. Employees can invest more money into 401(k) plans in 2024, with contribution limits increasing from $22,500 in 2023 to $23,000 in 2024.

Source: remyqjacquetta.pages.dev

Source: remyqjacquetta.pages.dev

Roth 2024 Limits Fifi Katusha, Employer matches don’t count toward this limit and can be quite generous. Maxed out roth 2024, what's next?

Source: gayelqcoralyn.pages.dev

Source: gayelqcoralyn.pages.dev

Average 401k Performance 2024 Tiffy Giacinta, This limit includes all elective employee salary deferrals and any contributions. For 2024, the 401(k) limit for employee salary deferrals is $23,000, which is above the 2023 401(k) limit of $22,500.

Roth 401k Limit 2024 Idalia Friederike, In 2023, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $22,500. Beginning this year (2024), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts.

Source: moneymonarchs.com

Source: moneymonarchs.com

401k 2024 Contribution Limit IRS Under SECURE Act 2.0, Every year, you can repeat this strategy to make annual contributions to a. So, owners of these roth 401(k) accounts no longer have to take.

Source: devondrawlexis.pages.dev

Source: devondrawlexis.pages.dev

What Is The Max Roth Contribution For 2024 Esma Odille, Free 401k calculator to plan and estimate a 401k balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Unlike roth iras, roth 401 (k)s don't have income limits.

Source: www.financestrategists.com

Source: www.financestrategists.com

Roth 401(k) Limit Overview, Benefits, and Drawbacks, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Beginning this year (2024), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts.

In 2024, The Limit Is $7,000 For People Younger Than 50 And $8,000 For People 50 And Older.

Contribution limits for simple 401(k)s in 2024 is $16,000 (from.

For 2024, The 401(K) Limit For Employee Salary Deferrals Is $23,000, Which Is Above The 2023 401(K) Limit Of $22,500.

This limit includes all elective employee salary deferrals and any contributions.