2025 Gifting Limit. When you start gifting money to friends and relatives, there are potential tax consequences that you should be aware of. Unless congress makes these changes permanent,.

The annual exclusion for gifts in 2023 is $17,000, up from $16,000 in 2022. The federal estate and gift tax exemption provision, a cornerstone of estate planning, is set to sunset after 2025 to its pre 2018 amount adjusted for inflation.

Learn How To Prepare Now.

Big names on the move as half the grid reshuffles for next season.

Irs Has Issued Proposed Regs And A News Release Concerning Various Effects Of The Increase In Gift And Estate Tax Exclusion Amounts That Are In Effect From.

If you gift over a certain limit, you could be on the hook to.

2025 Gifting Limit Images References :

Source: www.synchrony.com

Source: www.synchrony.com

Rapidly Growing Corporate Gifting Market Estimated to Reach 312, 50,000 per annum are exempt from tax in india. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For example, suppose you gift $7 million in 2025 when the individual limit is $13.61 million. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, With contracts expiring for nearly half the grid at the end of the season, f1. When you start gifting money to friends and relatives, there are potential tax consequences that you should be aware of.

Source: www.youtube.com

Source: www.youtube.com

S2EP49 The Art Of Gifting Limits, Transfers, Taxes, etc… YouTube, Unless congress makes these changes permanent,. The gift tax is intended to discourage large gifts that.

Source: www.youtube.com

Source: www.youtube.com

IRS changes both the 17,000 Gifting Limit and Estate Tax Exemption, Irs has issued proposed regs and a news release concerning various effects of the increase in gift and estate tax exclusion amounts that are in effect from. There's no limit on the number of individual gifts that.

Source: www.kreisenderle.com

Source: www.kreisenderle.com

What Are the Limits on Annual Gifting? Kreis Enderle, When you start gifting money to friends and relatives, there are potential tax consequences that you should be aware of. To take advantage of the increased exemption, adam and barb will need to make additional gifts prior to dec.

Source: rozelewdaisey.pages.dev

Source: rozelewdaisey.pages.dev

Personal Ira Contribution Limits 2025 Hannah Zonnya, In 2023, you can gift $17,000 a year to as many people as you want. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

Source: www.mortgagerater.com

Source: www.mortgagerater.com

How to Avoid Gift Tax 10 Easy Steps for Quick Savings, 31, 2025, likely to an irrevocable trust to benefit their. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

Source: usbytez.com

Source: usbytez.com

IRS Raises Gifting Limits Know How Much You Can Gift TaxFree, Washington — the treasury department and the internal revenue service today issued final regulations confirming that individuals taking advantage of the. In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from.

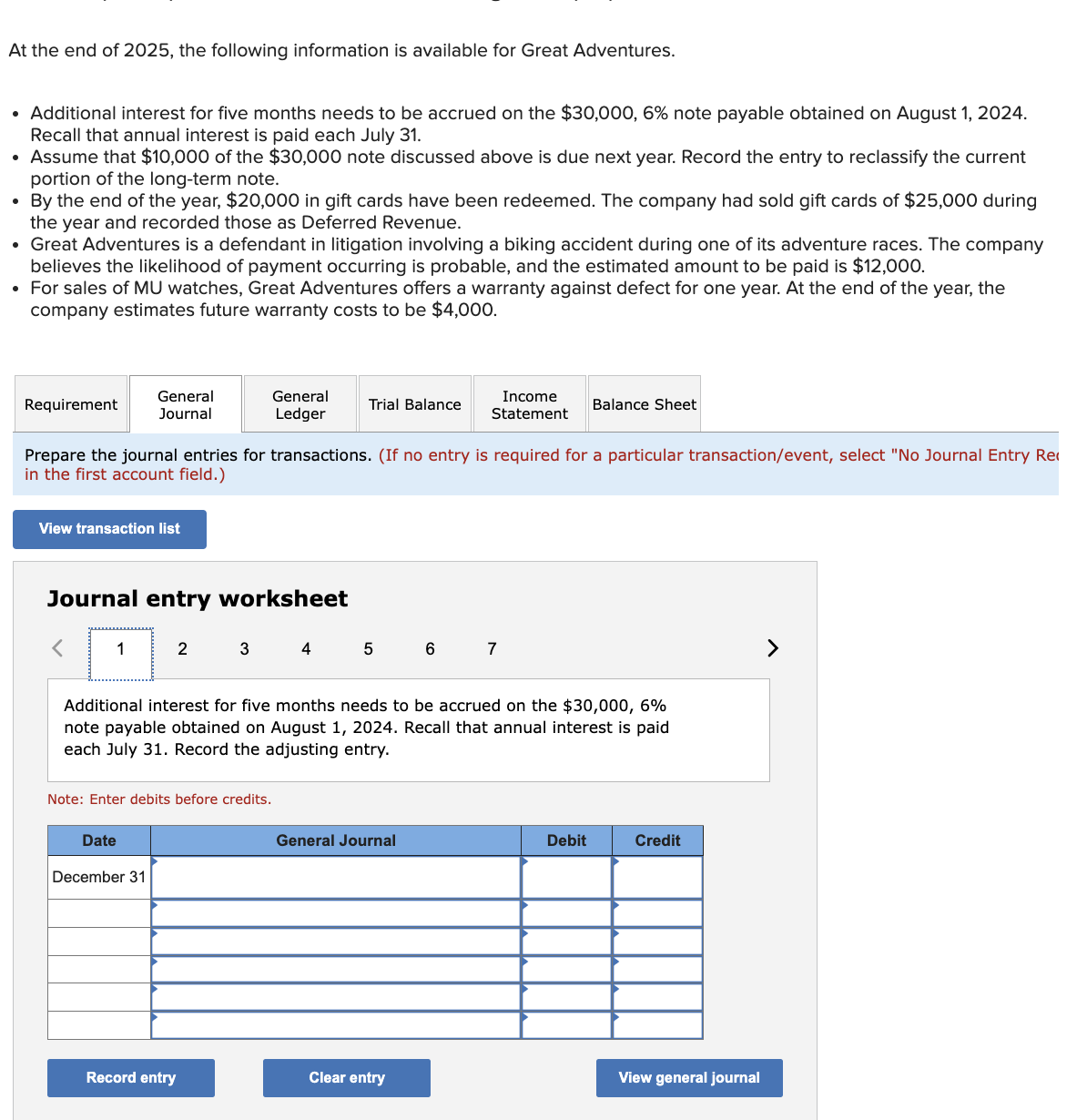

Source: www.chegg.com

Source: www.chegg.com

Solved At the end of 2025, the following information is, The current elevated estate and gift tax exemptions, introduced by the tax cuts and jobs act (tcja) of 2017, are set to expire on december 31, 2025. For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

The Annual Gift Tax Limit And The Lifetime Gift Tax Limit.

If you gift over a certain limit, you could be on the hook to.

Learn How To Help Your Clients Make The Most Of It Now.

When you start gifting money to friends and relatives, there are potential tax consequences that you should be aware of.

Category: 2025